The Facts About Hard Money Atlanta Revealed

Wiki Article

The Of Hard Money Atlanta

Table of ContentsA Biased View of Hard Money AtlantaA Biased View of Hard Money AtlantaThe Of Hard Money Atlanta4 Simple Techniques For Hard Money AtlantaHow Hard Money Atlanta can Save You Time, Stress, and Money.Fascination About Hard Money Atlanta

However, when you consider the tax savings, the effective rate of interest rate is minimized. Thinking you have an effective tax price of 25%, you 'd calculate your effective passion rate as adheres to: Simply put, when you factor in the tax obligation deduction given by interest settlements, that 15% tough cash lending rate successfully reduces to 11 (hard money atlanta).When considering the various other advantages of 100% funding a property offer, this effective decrease in passion prices makes financial obligation much more appealing. hard money atlanta. One of the significant benefits to making use of difficult money is that credit rating mainly doesn't matter. As long as you do not have any judgments or personal bankruptcies on your record, your credit rating won't impact your capability to get a lending.

Lenders conserve their finest prices for the most reliable consumers, generally those individuals with outstanding credit history. As well as, decreasing your passion rate just a little can save you 10s of thousands of dollars. A $200,000, 30-year home mortgage at 3. 5% will certainly set you back $42,000 much less in total interest payments than the same finance at 4.

The 9-Minute Rule for Hard Money Atlanta

Drop us a note, and also we'll function with you to build the very best funding prepare for your distinct realty investment needs!.

It uses potential investors a variety of financial as well as individual benefits, such as boosted cash circulation, residence appreciation, as well as tax obligation benefits. In reality, genuine estate financial investment continues to be just one of one of the most prominent lorries in producing economic wealth. According to the IRS, approximately 71 percent of Americans that declared greater than a million bucks on their tax return in the last 50 years were in property.

Hard Money Atlanta - An Overview

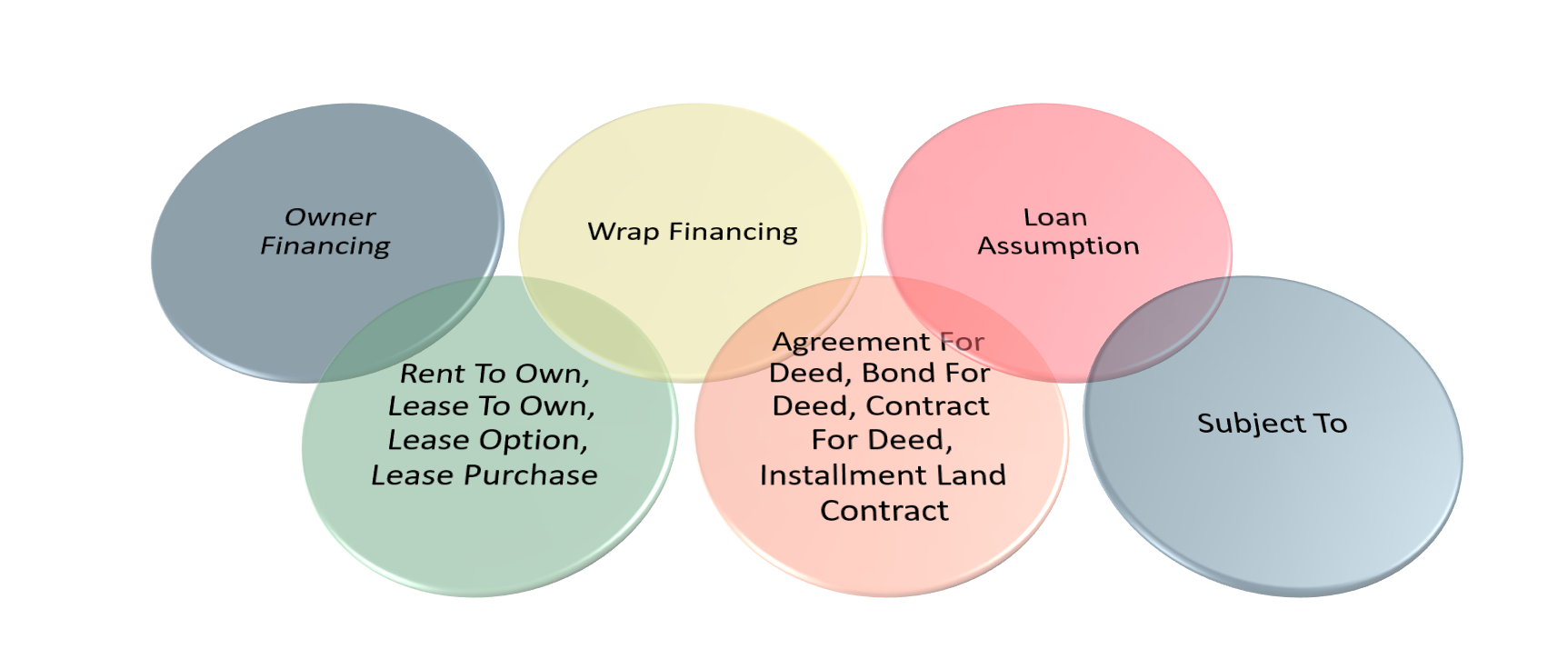

Continue reading to discover about a few of one of the most common kinds of property financing choices out there, in addition to prominent lendings for real estate investing. Take a 72-minute online training course and also find out 5 methods to fund your next deal!] Actual estate funding is normally used to explain a financier's approach of safeguarding funds for an approaching deal.Not unlike traditional funding, however, realty financing comes total with terms and underwriting, not the least of which need to be totally recognized before becoming part of an agreement. Among the biggest misconceptions of real estate investing is that you require to have a great deal of cash to obtain started, which isn't real.

Recognizing the financing facet is essential due to the fact that the technique in which a specific offer is moneyed can considerably affect its end result. As a financier, there are a couple of different methods to go around funding property investments. Each one will have its very own collection of benefits and drawbacks, and also your financing technique will certainly depend on the residential property as well as the circumstance.

How Hard Money Atlanta can Save You Time, Stress, and Money.

What benefit another person might not always help you, yet the trick is understanding which property funding choice will certainly compliment your service Visit Your URL technique. By taking the time to research the numerous realty funding options around, brand-new financiers are sure to recognize exactly how available investing can be.Remember that all financiers have encountered the funding hurdle at some time in their occupation; when unsure, there is absolutely nothing wrong with using your capitalist network as well as request for advice. Capitalists with an offer aligned have actually already achieved one of one of the most essential action in house flipping.

Hard Money Atlanta Can Be Fun For Everyone

Personal Cash Lenders: Investors who are well-connected can frequently touch right into resources from individual connections, obtaining cash at a defined rate of interest rate as well as repayment duration. Self Directed Individual Retirement Account Accounts: Individuals who have elected to create financial savings with a self-directed IRA might make the decision to use their account as a way to accessibility resources.As a capitalist, money is a significant device to obtaining what you desire. Along with getting extra provides approved, money funding allows capitalists to conserve on rate of interest, boost their money flow, visit their website and also obtain instant equity in their financial investment.

In the initial quarter of 2016, all-cash homebuyers for single-family houses as well as condominiums paid, on average, 23 percent less per square foot than all buyers nationwide, according to Real estate, Trac. It's essential to remember there will certainly be times when paying cash money for home makes sense and also other times when other financing alternatives must be thought about.

Not known Facts About Hard Money Atlanta

Tough money loan providers likewise charge fees apart from the passion on the car loan. These fees are normally marked in factors (3 to five), representing added portion costs based on the financing amount. Typically speaking, exclusive money loan providers will certainly provide financiers with money to acquire real estate homes in exchange for a specific rate of interest price.Report this wiki page